TAXABLE AND TAX EXEMPT BONDS

FOR EDUCATION AND RELATED FACILITES

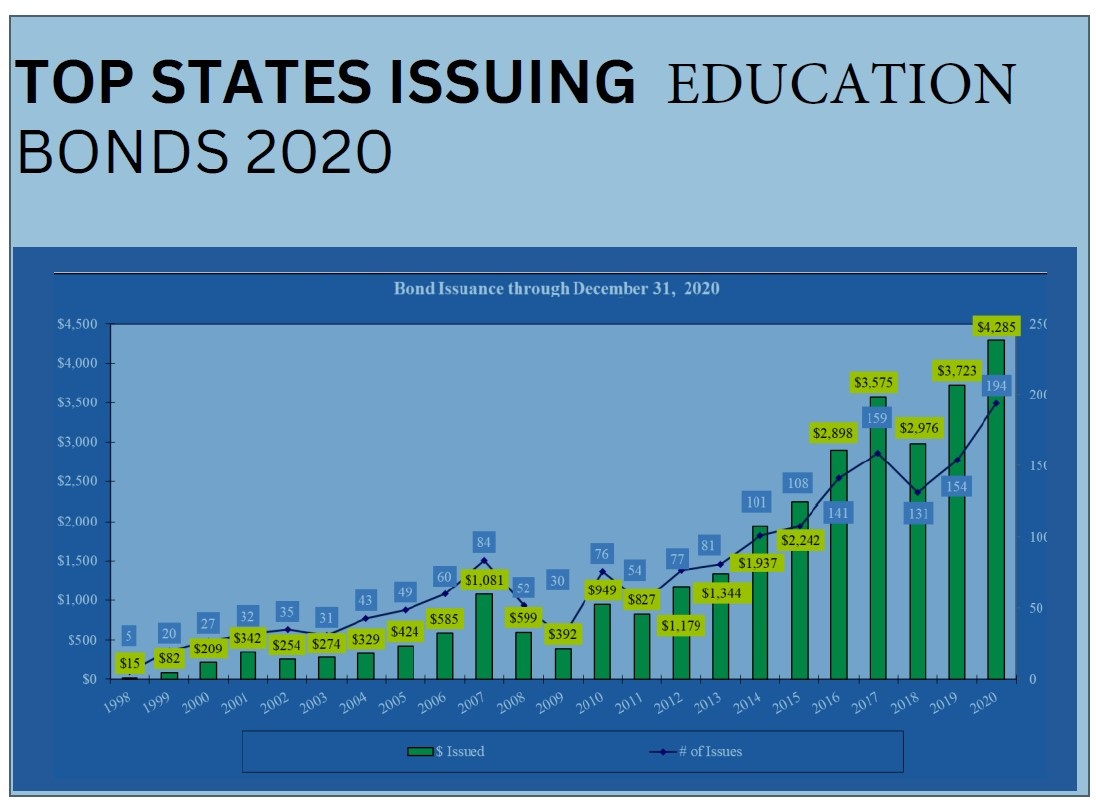

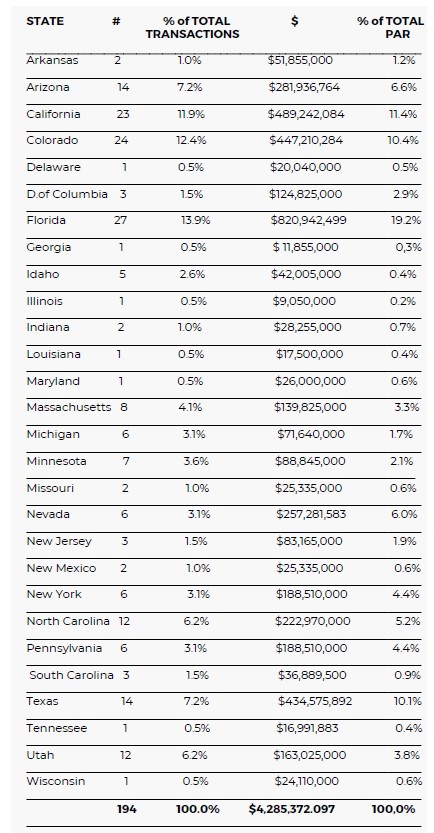

In 2020, education institutions completed a higher level of tax-exempt/taxable bond facility financings than in 2019. This was due, in part, to certain financings being accelerated in advance of the implementation of the Tax Cuts and Jobs Act, which went into effect in January 2018 and would have prohibited certain types of borrowings. Our research shows that approximately 100 publicly offered charter school bonds were issued in 22 states in 2020, totaling over $4.2 billion. This is a significant increase from an estimated $3.5 billion issuance in 2017. The highest par amount of bonds in 2020 was issued by Florida charter schools (over $820 million), followed by Colorado, Texas, and California.

By 2021, USA Education Fund had completed nine financings, totaling over $510 million. Below is a summary of the charter school bond issuances.

USA EDUCATION FUND GROUP

The USA Education Finance Group has provided assistance to education Institutions and management organizations in more than 26 education financings across the country. These financings have resulted in over 510 Million USD in funding for a range of projects, including:

- Land and facility acquisition

- Construction and renovation

- Leasehold improvements

- Refinancing of prior debt

- Furniture, fixtures and equipment

- Technology

- Project development costs